Time limit to avail Input Tax Credit | Things You Should Know

Input tax credit needs to be availed in a time bound manner. The relevant provisions of the time limit to avail ITC are covered under section 16(4) of the Central Goods and Services Tax Act, 2017.

GST

Vaishali Patel

6/29/20254 min read

Way back in the year 2002, the then Prime Minister of India, Shri Atal Bihari Vajpayee, proposed the need of Goods and Services Tax (GST) in India. After around 15 years of working and planning, GST was finally implemented on 1st July 2017. Article thoroughly explain the time limit to avail ITC, applicability of input tax credit and more.

One of the main objectives behind the introduction of GST was the seamless flow of Input Tax Credit (ITC). In simple terms, ‘Input Tax Credit’ means claiming the credit relating to GST i.e., tax paid on the purchase of the goods and services which are used for the furtherance of the business.

Importantly, such input tax credit needs to be availed in a time bound manner. The relevant provisions of the time limit to avail ITC are covered under section 16(4) of the Central Goods and Services Tax Act, 2017.

Notably, the said provisions were recently amended vide the Finance Act, 2022 and the said amended provisions were made effective from 1st October 2022 vide notification no. 18/2022- Central Tax dated 28th September 2022.

The present article briefly explains the provisions relating to the time limit to avail ITC as covered under section 16(4) of the Central Goods and Services Tax Act, 2017 along with the recent amendment.

As per earlier provisions of section 16(4) of the Central Goods and Services Tax Act, 2017, the registered person will not be entitled to avail the input tax credit after earlier of the following dates

· Due date of furnishing return in Form GSTR-3B for the month of September following the end of the relevant Financial Year; or

Due date of furnishing of the relevant annual return.

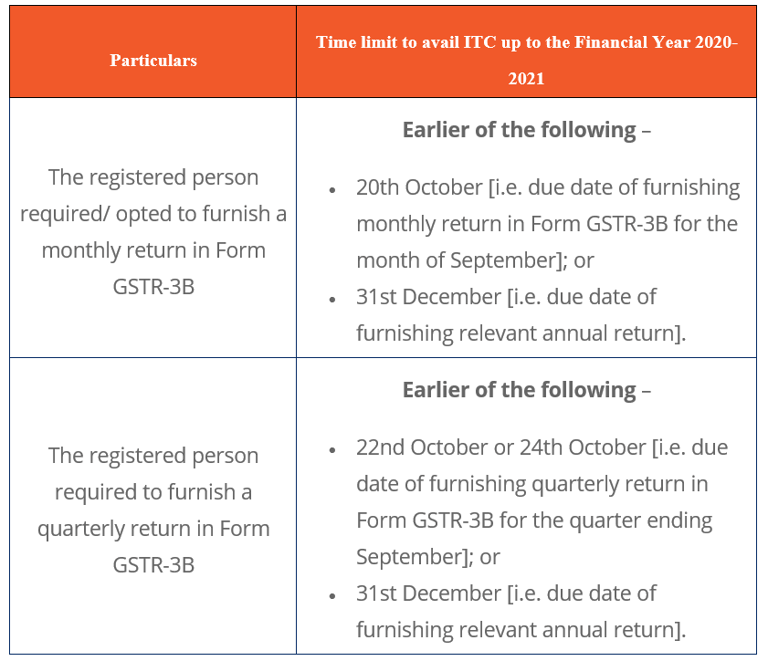

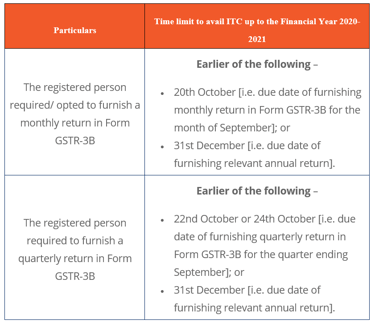

Based on the above provisions, the time limit to avail of ITC up to the Financial Year 2020-2021 is summarized hereunder

Particulars

Time limit to avail ITC up to the Financial Year 2020-2021

The registered person required/ opted to furnish a monthly return in Form GSTR-3B

Earlier of the following –

· 20th October [i.e. due date of furnishing monthly return in Form GSTR-3B for the month of September]; or

· 31st December [i.e. due date of furnishing relevant annual return].

The registered person required to furnish a quarterly return in Form GSTR-3B

Earlier of the following –

· 22nd October or 24th October [i.e. due date of furnishing quarterly return in Form GSTR-3B for the quarter ending September]; or

· 31st December [i.e. due date of furnishing relevant annual return].

It is important to note that in the above table, in the case of quarterly furnishing of return in Form GSTR-3B, two due dates i.e. 22nd October or 24th October are mentioned. The same depends on where the principal place of business is located as detailed in the table below –

State/ UT in which taxpayer is having principal place of business

Due date: 22nd October

State – Madhya Pradesh, Chhattisgarh, Maharashtra, Gujarat, Goa, Karnataka, Telangana, Kerala, Tamil Nadu or Andhra Pradesh.

Union Territory – Daman and Diu, Puducherry, Dadra and Nagar Haveli, Lakshadweep, Andaman and Nicobar islands.

Due Date: 24th October

State – Punjab, Himachal Pradesh, Uttarakhand, Rajasthan, Bihar, Uttar Pradesh, Sikkim, Nagaland, Arunachal Pradesh, Haryana, Sikkim, Manipur, Tripura, Mizoram, Assam, Meghalaya, West Bengal, Odisha, Jharkhand, Chandigarh or Delhi.

Union Territory – Ladakh, Jammu and Kashmir.

Time limit to avail input tax credit applicability 2021-2022

Vide section 100(b) of the Finance Act, 2022, the provisions of section 16(4) of the Central Goods and Services Tax Act, 2017 were amended.

Accordingly, as per the amended provisions of section 16(4) of the Central Goods and Services Tax Act, 2017, the registered person will not be entitled to avail input tax credit after earlier of the following dates –

· 30th November following the end of the relevant Financial Year; or

· Due date of furnishing the relevant annual return.

It is very important to note here that, as compared to the old provisions of section 16(4), even though the provisions attached with the due date of furnishing return in Form GSTR-3B is amended and the date 30th November is introduced. The due date for availing ITC should not be mistakenly taken as 30th November.

The reason certainly is the fact which still remains the same is that the input tax credit can be availed by any registered person via furnishing return in Form GSTR-3B. Hence, the time limit to avail of ITC from the Financial Year 2021-2022 will be worked out as under –

Time limit to avail ITC from the Financial Year 2021-2022

The registered person required/ opted to furnish a monthly return in Form GSTR-3B

Earlier of the following –

· 20th November [i.e. due date of furnishing monthly return in Form GSTR-3B for the month of October]; or

· 31st December [i.e. due date of furnishing relevant annual return].

The registered person required to furnish a quarterly return in Form GSTR-3B

Earlier of the following –

· 22nd October or 24th October [i.e. due date of furnishing quarterly return in Form GSTR-3B for the quarter ending September]; or

· 31st December [i.e. due date of furnishing relevant annual GST return].

Here too, the quarterly furnishing of return in Form GSTR-3B covers two due dates i.e. 22nd October or 24th October. As stated above, the same also depends on where the principal place of business is located as detailed in the table below –

State/ UT in which taxpayer is having principal place of business

Due date: 22nd October

State – Madhya Pradesh, Chhattisgarh, Maharashtra, Gujarat, Goa, Karnataka, Telangana, Kerala, Tamil Nadu or Andhra Pradesh.

Union Territory – Daman and Diu, Puducherry, Dadra and Nagar Haveli, Lakshadweep, Andaman and Nicobar islands.

Due date: 24th October

State – Punjab, Himachal Pradesh, Uttarakhand, Rajasthan, Bihar, Uttar Pradesh, Sikkim, Nagaland, Arunachal Pradesh, Haryana, Sikkim, Manipur, Tripura, Mizoram, Assam, Meghalaya, West Bengal, Odisha, Jharkhand, Chandigarh or Delhi.

Union Territory – Ladakh, Jammu and Kashmir.

Further, the above amended provisions of section 16(4) of the Central Goods and Services Tax Act, 2017, even though introduced vide the Finance Act, 2022, the same are made effective only from 1st October 2022.