Table 4 and 5 of Form GSTR-9 Explained: 10 Step Guide to Outward Supply

GST

Vaishali Patel

6/29/202512 min read

Table 4 and Table 5 of Form GSTR-9 pertain to reporting of outward supply.

In our previous blog we highlighted the break-up of the Annual Return Form-GSTR 9 in sections and sub-sections. We’ll now take up various sections of GSTR 9 for detailed analysis.

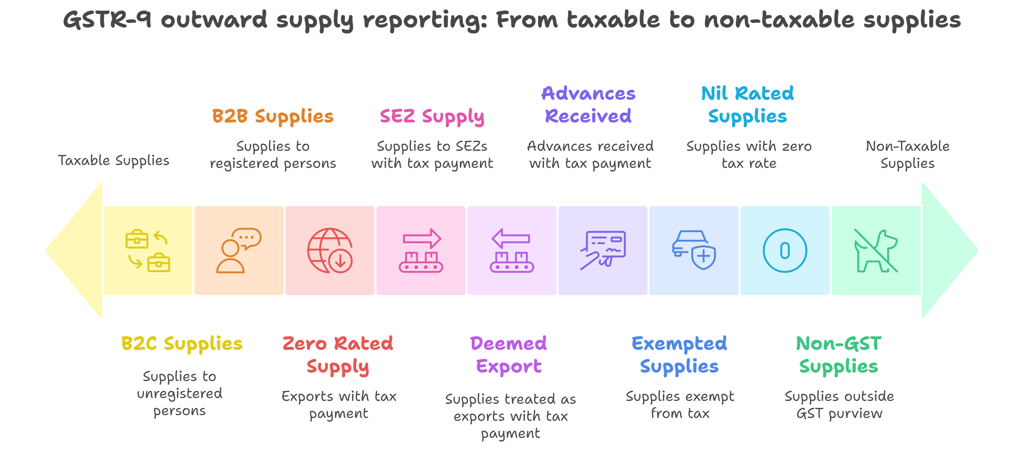

The GSTR-9 return form consists of 19 tables grouped into 6 parts. the 1st part which is initial 3 tables, covers the basic details such as financial year, GSTIN, legal name, and trade name while the 2nd part deal with outward supply comprising of Table 4 and Table 5 of Form GSTR 9. In this part, you need to provide consolidated details of all your outward supplies and advances received on which tax is applicable during the financial year for which the return is filed. You also need to fill details of outward supplies on which tax is not applicable as mentioned in the returns filed during the respective financial year.

This blog focuses on the outward supply details i.e. Table 4 and 5 of form GSTR 9.

A. Details of TAXABLE Advances, Inward and Outward supplies

Table 4 of GSTR 9 requires reporting of details related to taxable outward supplies (except Sl No. G which relates to inward supplies which attracts GST under reverse charge) like:

1. Supplies made to unregistered persons (B2C)

2. Supplies made to registered persons (B2B)

3. Zero rated supply (Export) on payment of tax (except supplies to SEZs)

New Addition: Details of advances, inward and outward supplies made during the financial year on which tax is payable. Below item line got added:

4G1 – Supplies on which e-commerce operator is required to pay tax as per section 9(5) (including amendments, if any) [E-commerce operator to report]

At the time of preparation of GSTR 9, whether the details required to be reported in Table 4 should be:

Restricted to details reported in the GSTR 1 for the period July 2017 to March 2018; or

Should include all the details pertaining to the period July 2017 to March 2018 irrespective of the period (Maximum period September 2018) when such details are reported in GSTR 1.

Based on the combined reading of Table 4 and Table 5 (Sl No 10 and 11) and the instructions related to these entries, one possible view is that:

Invoices related to 2017-18 reported in any month in the GSTR 1 during 2017-18 along with Amendments relating to 2017-18 made by reporting such amendment in any subsequent month but within 2017-18 itself would be reported at Table 4 of GSTR 9; and

Amendments to invoices related in any month in the GSTR 1 during 2017-18 made by reporting such amendment in the GSTR 1 during the months period April 2018 to September 2018 would only be reported in Part VI Sl.No. 10 of GSTR 9.

Table 4 of GSTR 9 contains details of advances and inward and outward supplies on which tax payable, as declared in returns, is filed during the financial year

1. Supplies made to unregistered Persons (B2C) – Sl.No. 4A

Aggregate value of supplies made to consumers and unregistered persons on which tax has been paid shall be declared here. These would include details of supplies made through ecommerce operators and are to be declared as net of credit notes or debit notes issued in this regard.

The amounts that are to be reported can be directly derived from the Tables of GSTR 1. The various components of this Part 4A would be as follows:

GSTR-1: Table-wise Reporting for Supplies to Unregistered Persons

Inter-State supplies to unregistered persons

Where invoice value > ₹2.5 lakh (whether through e-commerce operator or otherwise)

Report in: Table 5

Inter-State supplies to unregistered persons

Where invoice value ≤ ₹2.5 lakh (excluding supplies covered in Table 5)

Report in: Table 7

Intra-State supplies to unregistered persons

Other than supplies covered in Table 5

Report in: Table 7

Amendments to Inter-State taxable outward supplies

Amendments for earlier tax periods related to entries in Table 5

Includes debit notes, credit notes, refund vouchers issued during the current period

Report in: Table 9

Amendments to supplies reported in Table 7 (Inter and Intra-State)

Includes all taxable outward supplies to unregistered persons

Report in: Table 10

2. Supplies made to Registered Persons (B2B) – Sl. No. 4B

Aggregate value of supplies made to registered persons (including supplies made to UINs) on which tax has been paid shall be declared here. These would include supplies made through ecommerce operators but shall not include supplies on which tax is to be paid by the recipient on reverse charge basis. Details of debit and credit notes are to be mentioned separately.

The amounts that are to be reported can be directly derived from the Tables of GSTR 1. The various components of this part 4B would be as follows:

GSTR-1: Reporting of Taxable Outward Supplies to Registered Persons

Taxable outward supplies to registered persons

Includes supplies made to UINs

Excludes supplies attracting reverse charge and supplies through e-commerce operators

Nature of supply: Both inter-State and intra-State

Reported in: Table 4A

Taxable outward supplies to registered persons through e-commerce operators

Includes all such supplies, whether inter or intra-State

Reported in: Table 4C

3. Zero rated supply (Export) on payment of tax (except supplies to SEZs) – Sl. No. 4C

4C of GSTR 9 contains information relating to a sub-set of all zero-rated supplies comprising of exports of goods and exports of services out of India. 4C does not include supplies to SEZ. Further, exports are permitted in two ways, namely, export with payment of tax and export without payment of tax. 4C contains information pertaining only to exports on payment of tax and not exports without payment of tax.

The amounts that are to be reported can be directly derived from the Tables of GSTR 1. The various components of this part 4C would be as follows:

GSTR-1: Reporting of Export Supplies

Category of Supply: Aggregate value of exports (excluding supplies to SEZs) on which tax has been paid

Nature of Supply: Inter-State (as exports are treated as inter-State under GST)

Reported in: Table 6A

4. Supply to SEZs on payment of tax – Sl No. 4D

4D of GSTR 9 contains information relating to a sub-set of all zero-rated supplies comprising of supplies to SEZ being a developer of the SEZ or a unit in the SEZ. It would include supplies to SEZ whether by an SEZ to another SEZ or by a DTA unit to SEZ. 4D does not include supplies to SEZ without payment of tax.

The amounts that are to be reported can be directly derived from the Tables of GSTR 1. The various components of this Part 4D would be as follows:

GSTR-1: Reporting of Supplies to SEZs

Category of Supply: Aggregate value of supplies to SEZs on which tax has been paid

Nature of Supply: Inter-State (all SEZ supplies are deemed inter-State under GST)

Reported in: Table 6B

5. Deemed export – Sl. No. 4E.

4E of GSTR 9 contains information regarding ‘deemed export’. Section 147 allows the Government to notify certain supply of goods to be deemed exports where the goods supplied do not leave India and the payment for such supplies is received either in Indian rupees or in convertible foreign exchange if such goods are manufactured in India. The deeming fiction of this kind of supply as deemed export allows a person to enjoy all the tax benefits as available in case of zero-rated supply.

Section 147 and NN 48/2017-Central tax dated 18th October 2017, prescribes the following supplies to be regarded as deemed exports:

1. Supply of goods against advance authorization

2. Supply of capital goods against EPCG authorization

3. Supply of goods to EOU (export-oriented undertakings)

4. Supply of gold by bank/PSU specified in Notification no. 50/2017-Customs dated 30th June 2017

The amounts that are to be reported can be directly derived from the Tables of GSTR 1. The various components of this part 4E would be as follows:

GSTR-1: Reporting of Deemed Exports

Category of Supply: Aggregate value of supplies in the nature of deemed exports on which tax has been paid

Nature of Supply: Inter-State (deemed exports are treated as inter-State supplies for reporting purposes)

Reported in: Table 6C

6. Advances on which tax has been paid but invoice has not been issued – Sl. No. 4F

4F of GSTR 9 contains details of advances received in certain special circumstances. As per rule 50, upon receipt of advance, Receipt Voucher is required to be issued but tax Invoice is not required to be issued until actual supply in respect of said advance. Tax is payable on advance even though supply is pending. 4F to contain details of advances received and tax invoice is yet to be issued.

Refer NN 40/2-17-CT dated Oct 13, 2017 that exempted payment of tax on advances received towards supply of goods, in case of taxable persons whose aggregate turnover is or is likely to be less than Rs.1.50 cr. Advances towards supply of services remained liable to payment of tax on advances. Suppliers of goods above this threshold limit also were liable to payment of tax on advances.

Refer NN 66/2017-CT dated Nov 11, 2017 that exempts from payment of tax on advances received towards supply of goods. As such, advances should have been subject to tax payment in all cases up to Nov 10, 2017 and in respect of advances relating to supply of services without the benefit of this exemption.

The amounts that are to be reported can be directly derived from the Tables of GSTR 1. The various components of this Part 4F would be as follows:

GSTR-1: Reporting of Advance Received (Without Invoice)

Category of Supply: Advance received, and tax has been paid, but invoice has not been issued in the current financial year

Nature of Supply: Both inter-State and intra-State

Reported in: Table 11A

7. Inward supplies on which tax is to be paid on reverse charge basis – Sl No. 4G.

4G in GSTR 9 contains details of inward supplies in respect of which registered person is liable to pay tax on reverse charge basis.

Reverse charge provisions are guided through section 9(3) and 9(4) of the CGST Act in case of intra state supplies. In case of inter-state supplies, the corresponding sections of 5(3) and 5(4) of the IGST Act would be applicable.

Refer NN 8/2017-CT(R) dated Jun 28, 2017 exempts intra-State supply of goods or supply of services does not exceed Rs.5,000/- per day regardless of number of suppliers involved. Refer NN 38/2017-CT(R) dated Oct 13, 2017 which excluded the value limit previously prescribed. Corresponding Integrated tax exemption was issued for the first time in NN 32/2017-Int(R) dated Oct 13, 2017 in respect of inter-State supplies.

The amounts that are to be reported can be directly derived from the Tables of GSTR 3.B. The various components of this Part 4G would be as follows:

GSTR-3B: Reporting of Inward Supplies Liable to Reverse Charge

Category of Supply: Aggregate value of all inward supplies (including advances, and net of credit and debit notes) on which tax is to be paid under Reverse Charge Mechanism (RCM)

Nature of Supply: Both inter-State and intra-State

Reported in: Table 3.1(d)

8. Credit notes issued in respect of transactions specified in (B) to (E) above – Sl. No. 4I

4I in GSTR 9 contains details of credit notes in respect of outward supplies in 4B to 4E of GSTR 9. Credit notes dated before Mar 31, 2018 alone is required to be reported and not Credit notes relating to 2017-18 but issued in 2018-19. Aggregate value of credit notes issued in respect of B to B supplies (4B), exports (4C), supplies to SEZs (4D) and deemed exports (4E) shall be declared here.

The amounts that are to be reported can be directly derived from the Tables of GSTR 1. The various components of this Part 4H would be as follows:

GSTR-1: Reporting of Credit Notes

Category of Supply: Aggregate value of credit notes issued in respect of:

B2B supplies

Exports

Supplies to SEZs

Deemed exports

Nature of Supply: Both inter-State and intra-State

Reported in: Table 9B

9. Debit notes issued in respect of transactions specified in (B) to (E) above – Sl. No. 4J

4J in GSTR 9 contains details of debit notes in respect of outward supplies in 4B to 4E of GSTR 9. Debit notes dated before Mar 31, 2018 alone is required to be reported and not debit notes relating to 2017-18 but issued in 2018-19. Aggregate value of debit notes issued in respect of B to B supplies (4B), exports (4C), supplies to SEZs (4D) and deemed exports (4E) shall be declared here.

The amounts that are to be reported can be directly derived from the Tables of GSTR 1. The various components of this Part 4J would be as follows:

GSTR-1: Reporting of Debit Notes

Category of Supply: Aggregate value of debit notes issued in respect of:

B2B supplies

Exports

Supplies to SEZs

Deemed exports

Nature of Supply: Both inter-State and intra-State

Reported in: Table 9B

10. Supplies / tax declared through amendments – Sl. No. 4K and 4L

4K - Supplies / tax declared through Amendments (+)

4L - Supplies / tax reduced through Amendments (-)

Details of amendments made to B to B supplies (4B), exports (4C), supplies to SEZs (4D) and deemed exports (4E), credit notes (4I), debit notes (4J) and refund vouchers shall be declared here. Table 9A and Table 9C of FORM GSTR-1 may be used for filling up these details.

As per section 39(9) of the CGST Act, if any Registered Person discovers any omission or incorrect particulars, he can rectify such omission or incorrect particulars in the return to be furnished for the month during which they are noticed.

Further, Circular no. 26/26/2017-GST dated Dec 29, 2017 prescribes the procedure for a person to correct any error or omission made in his GSTR 3B and GSTR 1. It is important to note that declaration of omissions and amendment to declaration already made are permitted in any subsequent month even in the returns of Apr to Sept 2018.

Such declarations and amendments by transposing from one month to another but within 2017-18 must be reported here. Continuation of such declaration and amendments in 2018-19 of data relating to 2017-18 is not permitted in point 4K. It is required to be carried in Pt. V point 10 and 11, as applicable.

The amounts that are to be reported can be directly derived from the Tables of GSTR 1. The various components of this Table 4K and 4L would be as follows:

GSTR-1: Reporting of Amendments

Amendments in B2B Supplies, Exports, SEZ Supplies, Deemed Exports

Reason: Corrections in invoice or shipping bill details furnished in earlier returns

Nature of Supply: Both inter-State and intra-State

Reported in: Table 9A

Amendments in Credit Notes, Debit Notes, and Refund Vouchers

Nature of Supply: Both inter-State and intra-State

Reported in: Table 9C

B. Details of Outward supplies on Which Tax is not Payable

The details on outward supplies on which tax is not payable needs to be reported under Table 5 of GSTR 9. A recent clarification has been issued on Table 5D, 5E and 5F

New Addition: Details of Outward supplies made during the financial year on which tax is not payable.

5C1 – Supplies on which tax is to be paid by e-commerce operators as per section 9(5) [Supplier to report]

And as these new item lines got added its impact on calculated values will be seen.

Total Turnover (including advances) (4N + 5M – 4G – 4G1)

Updates:

4th June 2019: Clarifications released by CBIC around GSTR 9 preparation, suggest that:

Clarifications regarding Part II of Form GSTR-9

1) In Part II of Form GSTR-9 only the following transactions will be disclosed,

a) Transactions in respect of which the tax is paid in Form GSTR-3B for the period Jul ’17 to Mar ’18 (irrespective of when such transaction was disclosed in Form GSTR1), [point ‘d’ of press release] or

b) Any additional outward supply not declared in Form GSTR-1 and GSTR-3B to be disclosed in the Part II. However, tax element in respect of these transactions shall be declared in Part IV in ‘Tax Payable’ and the differential tax shall be paid vide DRC-03. [point ‘e’ of press rlease]

Comment :– There are instances where there are differences between the details auto-populated in Table 4 of Form GSTR-9 and the actual entry in the books of accounts or returns. It is clarified that Table-4 can be altered by the taxpayer reflecting the actual tax paid as per returns / DRC-03 and auto-population is only a functionality provided to the taxpayer.

03 July 2019: As per the clarification issued by CBIC:

Information in Table 5D (Exempted), Table 5E (Nil Rated) and Table 5F (Non-GST Supply):

It has been represented by various trade bodies/associations that there appears to be some confusion over what values are to be entered in Table 5D,5E and 5F of FORM GSTR-9. Since, there is some overlap between supplies that are classifiable as exempted and nil rated and since there is no tax payable on such supplies, if there is a reasonable/explainable overlap of information reported across these tables, such overlap will not be viewed adversely.

Non – GST Supply:

The other concern raised by taxpayers is the inclusion of no supply in the category of Non-GST supplies in Table 5F.

For the purposes of reporting, non-GST supplies includes

– supply of alcoholic liquor for human consumption,

– motor spirit (commonly known as petrol),

– high speed diesel,

– aviation turbine fuel,

– petroleum crude and

– natural gas and

– transactions specified in Schedule III of the CGST Act.

Do you know about IRIS GST software solution

It’s a GST Software trusted by top Indian companies! A cloud-based GST software that helps you to automate your GST Return filing, optimise Reconciliation results and increase ITC claim without any hassle. It’s a powerful GST Return filing that supports multiple GST Return filing, PAN level data view, bulk operations, advanced 2A-Purchase Register reconciliation tool, vendor management and gets you 100 % ITC Claims.

How does IRIS GST Software help with GSTR 9?

· One-click download of GSTR 1, 2A, 2B and 3B data

· Reports on Tables 6, 10, 11, 13, 17 and 18 helps in auto-population

· In-built audit trail at an invoice level for each entry (Invoice-wise, month-wise and section-wise bifurcation of all values)

· One-click GSTR-9 data upload for all GSTINs

· Need not wait for year-end, you can get all reports at the end of any month

· A checklist of periods for which you have fetched data from GSTN. This is available return-wise for GSTR 1, 2A and 3B

· Comparison between IRIS auto-calculated data and GSTN auto-calculated data

· Quick reports on differences between table 8 of GSTR 9 vs GSTR 2a vs GSTR 2B vs Purchase Register

IRIS GST Software’s GST Reconciliation module has been built considering the requirements of various industries such as manufacturing, pharmaceuticals, automobiles etc., and has market-tested logic to reconcile the buyer-supplier data across various parameters to reduce manual intervention.